How are credit scores measured?

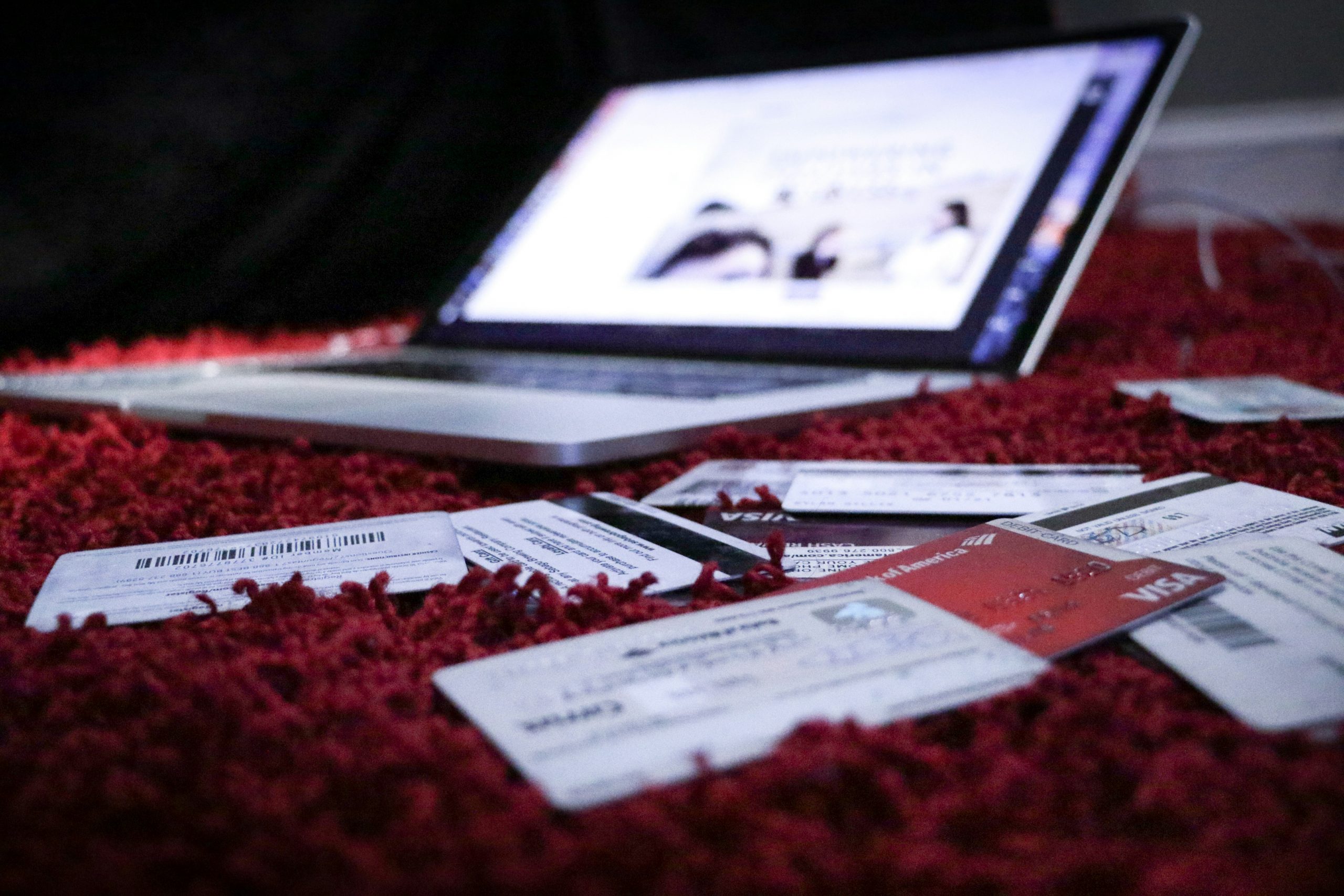

Understanding how credit scores are measured can be crucial for anyone looking to build credit history and maintain a good credit score. A credit score is a numerical representation of an individual’s creditworthiness, showing lenders and credit card issuers how likely they are to pay back debt. With the typical credit score range falling between 300 and 850, understanding what factors contribute to your score can help you take the necessary steps to improve it.

One important thing to note is that each credit reporting agency calculates credit scores slightly differently, using their own unique credit scoring model. However, there are common factors that are generally taken into account when determining your credit score.

Payment History

The first and most significant factor is your payment history, which accounts for about 35% of your credit score. This includes your ability to make on-time payments for your credit accounts. Late payments, defaults, or bankruptcies can significantly lower your credit score. One late payment can cause a 50 point or higher loss!

Credit Utilization

The next factor are the amounts owed, making up around 30% of your credit score. This looks at the amount of debt you owe in relation to your credit limits. Keeping your credit card balances low and paying off debts can positively impact this part of your credit score. When your credit cards are maxed out, the credit reporting agencies see it as irresponsible and penalize your credit score.

- If you’re able to pay down existing debt, your credit utilization will improve.

- If your loan shopping, low credit utilization will secure better terms.

- Your credit utilization shows lenders how well you’re able to manage credit & debt.

Credit History Length

The length of your credit history is also important, accounting for about 15% of your credit score. Lenders like to see a long track record of responsible credit use, so opening new credit accounts can lower the average age of your accounts and potentially lower your credit score. Credit advisors often discourage getting rid of credit cards that are paid off that have been reported for years, as the age of the account is removed when closed along with the available credit which can drop your credit utilization.

Inquiries for new credit

Newly opened credit accounts and credit inquiries make up about 10% of your credit score. This looks at how often you apply for new credit, as multiple inquiries within a short period can signal financial distress. Creditors also look at the amount of new credit.

Credit Mix or Types of Credit Reported

Lastly, your credit mix makes up around 10% of your credit score. Lenders like to see a mix of different types of credit accounts, such as credit cards, mortgages, and auto loans. The difference between revolving vs installment credit is important.

Examples of a Credit Mix

- Installment loans (student or auto loan)

- Mortgages

- Revolving debt (line of credit or credit card)

- Open account

Lenders like to see the ability to manage different types of credit over time successfully.

In conclusion, understanding how credit scores are measured and the factors that contribute to them can help you make informed decisions to build and maintain a good credit score. By focusing on factors like payment history, amounts owed, length of credit history, new credit inquiries, and credit mix, you can work towards improving your creditworthiness and securing better financial opportunities in the future.

If your credit needs help, book an appointment and let’s talk about how our credit restoration can help get your credit score up!